geothermal tax credit form

Taxpayers filing a claim for the Geothermal Tax Credit were required to submit Form IA 140 in addition to the IA 148 with the individual income tax return. A 26 federal tax credit for residential ground source heat pump installations has been extended through December 31 2022.

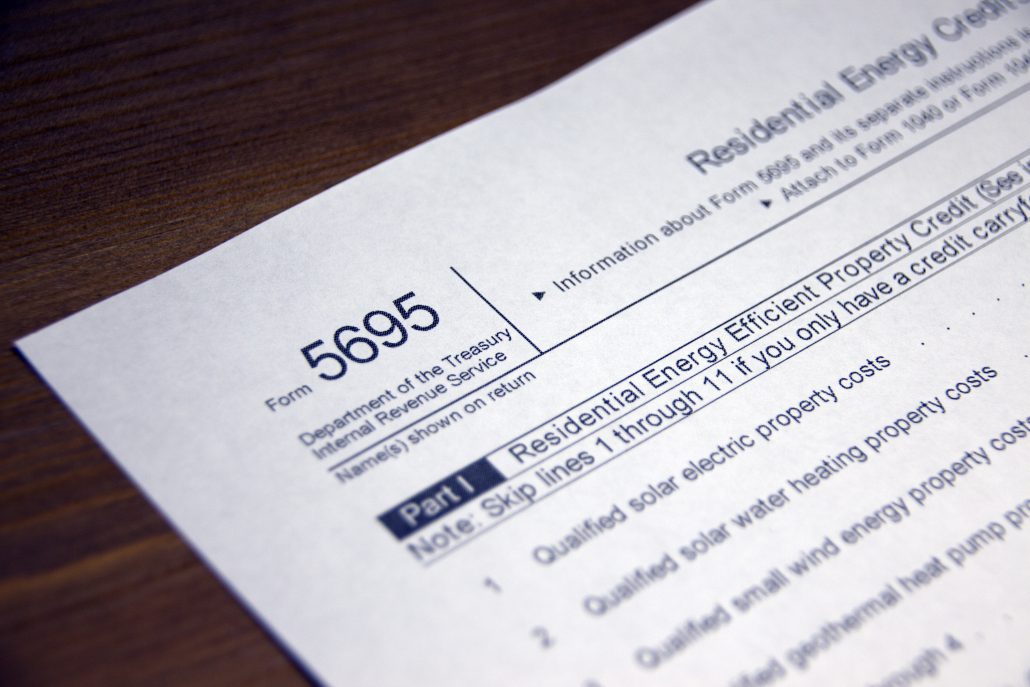

Instructions For Filling Out Irs Form 5695 Everlight Solar

Quick steps to complete and e-sign Fillable Online Understand The Geothermal Tax Credit online.

. Use the Cross or Check marks in the top toolbar to select your answers in the list boxes. This credit was repealed by the 2021 Montana State Legislature. Start completing the fillable fields and carefully type in required information.

To offset the high upfront cost of geothermal heat pump installation and to incentivize renewable energy integration within commercial businesses the federal government issued a tax credit for geothermal systems. Use IRS Form 5695 to claim the Residential Energy Efficient Property Credit. From 2017 to January of 2018 there was an ongoing fight to extended this tax credit.

It operates using the power of the earth. The tax credit can be used to offset both regular income taxes and alternative minimum taxes AMTIf the federal tax credit exceeds tax liability the excess amount may be carried forward into future years. The Geothermal Tax Credit filed through form 5695 covers expenses associated with the installation of ground source heat pumps.

This includes labor onsite preparation equipment assembly and the necessary piping and wiring used when connecting the system to the home. The tax credit equaled 10 of the taxpayers qualified. The Geothermal Tax Credit was available for installations beginning on or after January 1 2017 through December 31 2018.

You may still carry forward any remaining tax credit until the carryforward period expires. Geothermal heat pumps are similar to ordinary heat pumps but use the ground instead of outside air to provide heating air conditioning and in most cases hot water. The tax credit can be used to offset both regular income taxes and alternative minimum taxes AMT.

Attach to Form 1040. The underground part of the system consists of the piping which is the main part of. You may use this form to claim your geothermal system credit.

A 30 tax credit for the installation of a ground source heat pump geothermal system with no cap was enacted in 2009. 100000 x 10 10000 2013 Depreciation Benefit. US Tax Credits Through 2023.

The LLC owners are in a 40 marginal tax bracket when state income tax is included 2020 Tax Credit. Use IRS Form 5695 and Form 1040 to apply for a geothermal tax credit. 95000 x 100 special x 40 tax rate 38000.

The tax credit can be used to offset both regular income taxes and alternative minimum taxes AMT. This Tax credit was available through the end of 2016. Geothermal energy earth-based heat -- offers a clean sustainable alternative to traditional HVAC systems.

Geothermal HVAC Independence project implies using a unique eco-friendly fossil-free heating and cooling system. You may not claim this credit after Tax Year 2021. Geothermal System Credit Form ENRG-A December 30 2021.

The tax credit equals 10 of the taxpayers qualified expenditures. Geothermal heat pumps that were origionally installed in 1992. For property placed in service after 2009 theres no limit on the credit amount.

Form 5695 2021 Residential Energy Credits Department of the Treasury Internal Revenue Service Go to wwwirsgovForm5695 for instructions and the latest information. The Geothermal Tax Credit was available for installations beginning on or after January 1 2017 through December 31 2018. Taxpayers filing a claim for the Geothermal Tax Credit must submit Form IA 140 in addition to Schedule IA 148 with the individual income tax return.

For property placed in service after 2009 theres no limit on the credit amount. How to Claim the Credit. Not to be confused with the 26 percent residential tax credit the federal geothermal tax credit for commercial geothermal heat pumps is 10 percent.

Ultimately the tax credit was reinstated in early February 2018. Use IRS Form 5695 to claim the Residential Energy Efficient Property Credit. Residential Energy-Efficient Property Credit.

For property placed in service after 2009 thereâs no limit on the credit amount. The energy tax credit can be combined with solar and wind credits as well as energy efficiency upgrade credits. Use IRS Form 5695 to claim the Residential Energy Efficient Property Credit.

In fact the average temperature of the earth is about 45-75 degrees Fahrenheit per kilometer of depth. Because they use the earths natural heat they are among the most efficient and comfortable heating and cooling technologies. The project is completed in the 3rd quarter of 2020.

GEO provides outreach to the industry public and government about the economic national security and environmental benefits of geothermal heat pump systems for residential institutional and commercial applications. If the federal tax credit exceeds tax liability. Use Get Form or simply click on the template preview to open it in the editor.

Instructions For Filling Out Irs Form 5695 Everlight Solar

Form 5695 Claiming Residential Energy Credits Jackson Hewitt

Tax Credit Mla Geothermal Drilling Llc

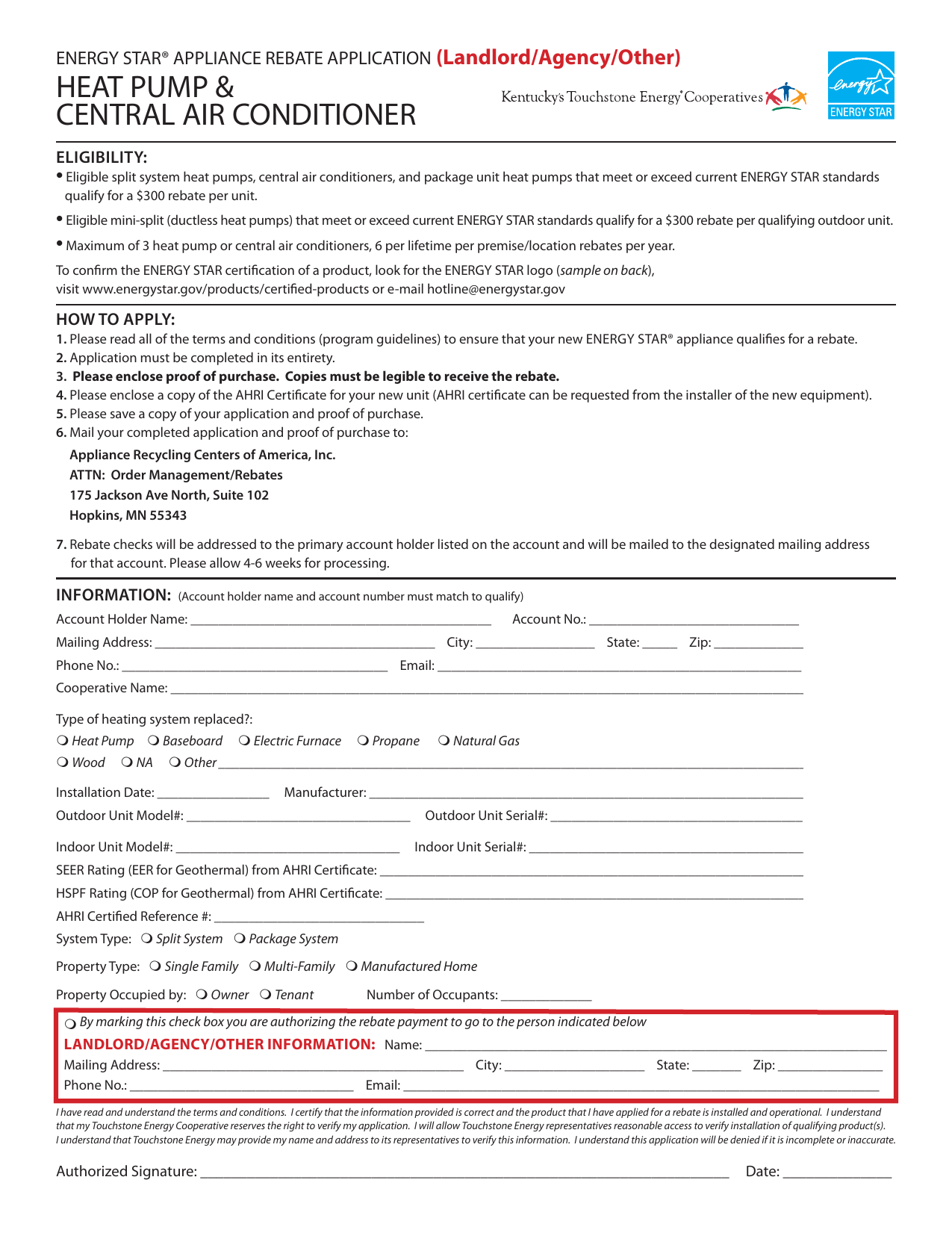

Hvac Equipment Rebate Application Form Pennsylvania

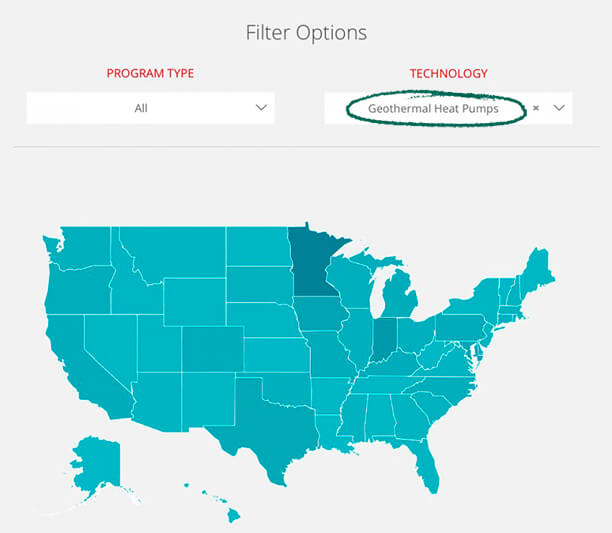

Questions Answered Federal Tax Credits And Local Incentives For Residential Geothermal Installation

Pdf Probabilistic Assessment Of Geothermal Resources And Their Development In Dikili Izmir Region

Form 5695 Claiming Residential Energy Credits Jackson Hewitt

How The 2022 Federal Geothermal Tax Credit Works

Filing For Residential Energy Tax Credits What You Need To Know

Es Forms V4 Landlord Indd Manualzz

Form 5695 Instructions Claiming The Solar Tax Credit Energysage

How To Claim The Solar Tax Credit Boston Solar Ma