san antonio local sales tax rate 2019

The minimum combined 2022 sales tax rate for San Antonio Texas is. The December 2020 total local.

Here is a look at what the brackets and tax rates are for 2019-2020.

. Local Code Rate Effective Date. Is a veteran staff writer. Texas Comptroller of Public Accounts.

San Antonio collects the maximum legal local sales tax. The minimum combined 2020 sales tax rate for San Antonio Texas is 825. The 7 sales tax rate in San Antonio consists of 6 Florida state sales tax and 1 Pasco County sales tax.

The San Antonio Texas general sales tax rate is 625. Among major cities Chicago Illinois and Long Beach and Glendale. The portion of the sales tax rate collected by San Antonio is 125 percent.

There are over 11000 sales tax jurisdictions in the United States with widely varying rates. Combined Area Name Local Code Rate. Sales Tax Calculator of San Antonio for 2019.

If you have questions about Local Sales and Use Tax rates or boundary information. This is the total of state. The current total local sales tax rate in San Antonio TX is 8250.

05 lower than the maximum sales tax in FL. There is no applicable county tax. The City of San Antonio has an interlocal agreement with the Bexar County Tax Assessor-Collectors Office to provide property tax billing and collection services for the City.

Sales and Use Tax San Antonios current sales tax rate is 8250 and is distributed as follows. The County sales tax. Every 2019 combined rates mentioned above are the results of Texas state rate 625 the county rate 0 to 05.

The process used is dependent on benchmark rates known. The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax. This is the total of state county and city sales tax rates.

There is no applicable city tax or. Local Code Local Rate Total Rate. Each tax year local government officials such as City Council Members School Board Members and Commissioners Court examine the taxing units needs for.

0125 dedicated to the City of San Antonio Ready to Work. 1000 City of San Antonio. 0495 as of 2019 tax year.

City sales and use tax codes and rates. The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax. The Texas sales tax rate is currently.

4 rows San Antonio TX Sales Tax Rate. The Official Tax Rate. The current total local sales tax rate in San Antonio.

How To Calculate Sales Tax On Almost Anything You Buy

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

Texas Sales Tax Guide And Calculator 2022 Taxjar

Study Despite Having No Income Tax Texas Has 11th Highest Tax Rate In The Country San Antonio News San Antonio San Antonio Current

15 States With No Income Tax Or Very Low Which States Can Save You The Most Bhgre Homecity

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price

Tax Reform Faqs Top Questions About The New Tax Law Bdo

Texas Car Sales Tax Everything You Need To Know

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

Covid 19 S Fiscal Ills Busted Texas Budgets Critical Local Choices Dallasfed Org

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Business Tax Compliance And Complexity Tax Foundation

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price

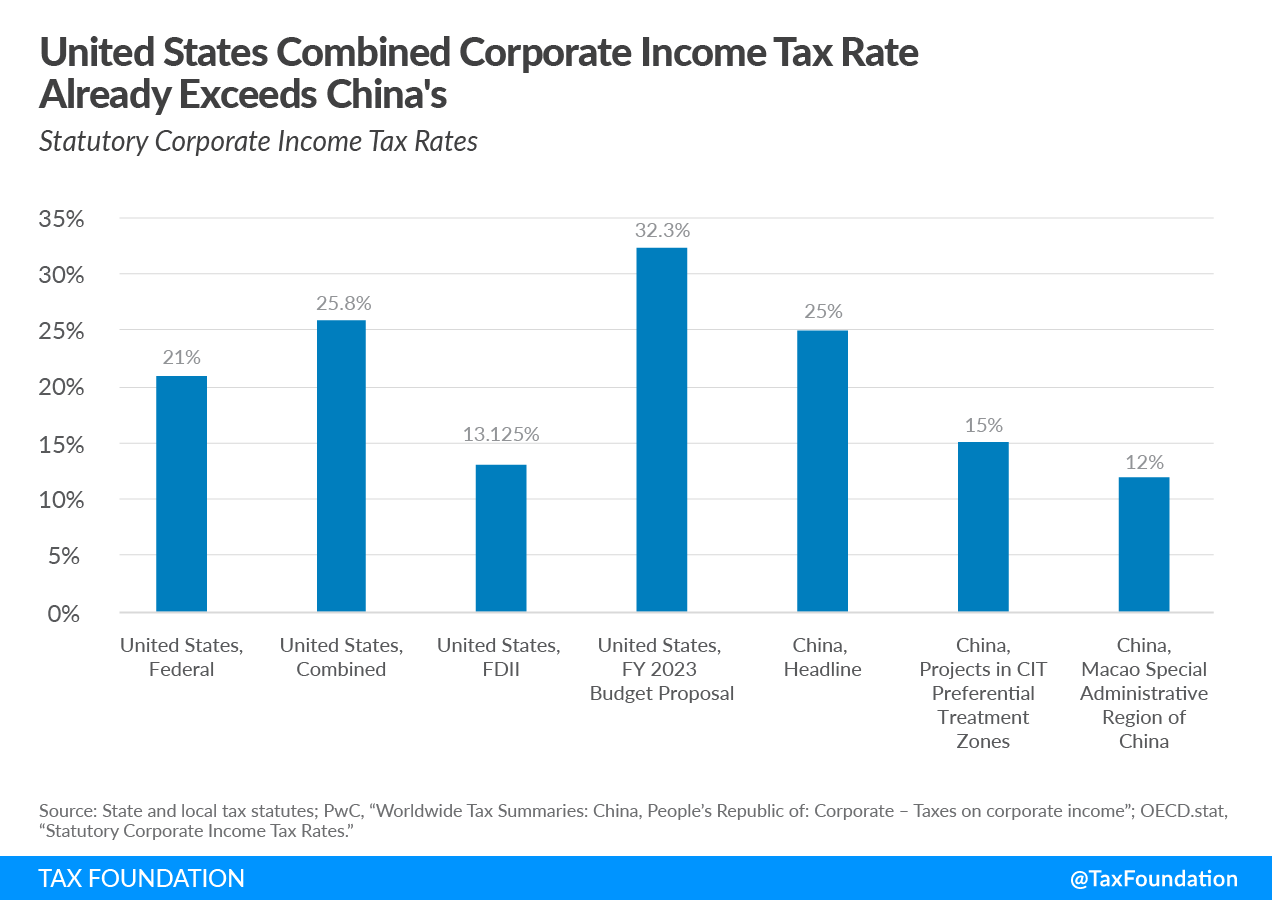

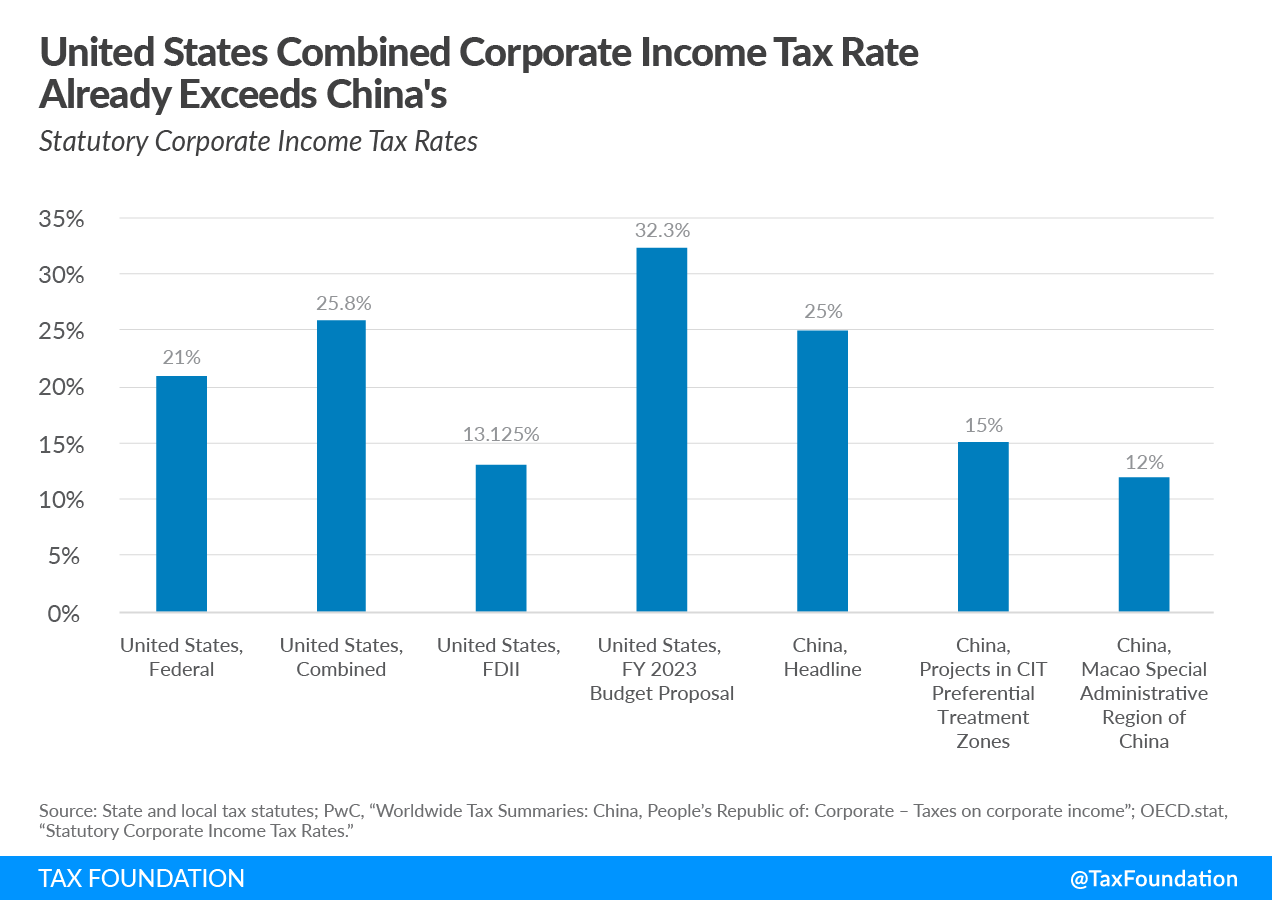

Tax Proposals Comparisons And The Economy Tax Foundation

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation